On May 6, Inman News’ Paul Hagey reported home flippers’ Q1 average profits at $72,450 showing “larger returns from their fix-and-sell hustle in the first quarter than they have in the past four years that RealtyTrac has been publishing its U.S. Home Flipping Report.”

On May 6, Inman News’ Paul Hagey reported home flippers’ Q1 average profits at $72,450 showing “larger returns from their fix-and-sell hustle in the first quarter than they have in the past four years that RealtyTrac has been publishing its U.S. Home Flipping Report.”

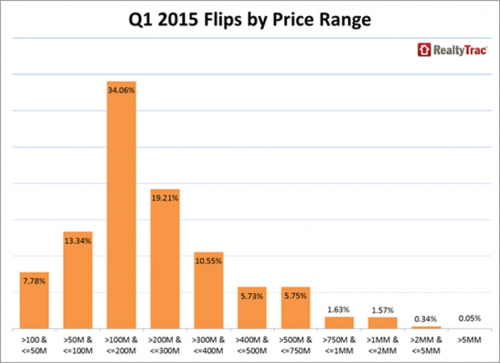

Prospective flippers reading the report were treated to a venti doubleshot of courage in stats that touted a “17.4 percent jump in average profit per flip over the first quarter of 2014” and ROI exceeding 35% for the previous 12 months.

Are House Flippers Poised to Rush Back into the Residential Housing Market?

Maybe not, if commenters to the article are to be believed. Here’s a sampling of readers’ skeptical commentary:

“As a former math teacher and a former house flipper I am appalled by this article. Awfully liberal use of “gross profits” … If this was even close to the money flippers make, everyone would be doing it and I would expect to see a lot more Corvettes at REIA meetings.”

“Great information…..My flippers here in the San Francisco Bay area aren’t seeing ROI like these areas as indicated in the article…..They would love those numbers!”

“This article does not take into account the cost of construction, holding or selling costs. There is no way that flippers are making the kind of returns mentioned in this article, unless the property needs no work at all.”

Share your experience. What’s your take on House Flipping in the bay area?

Recent Comments